I think corporate tax rates need to be raised, not lowered. And I say this even though I am the sole individual shareholder in my company (it's partly owned by a charitable foundation), which has a corporate form of ownership . . .

A pair of reasons . . .

A pair of reasons . . .

- Both corporate tax rates, and personal tax rates for individuals in high income brackets, have been unrealistically low for some years now - very much so. (Download the tax tables - personal and corporate - from back in the fifties and early sixties, when the economy was the best it has ever been, before or since, compare what you see to the current tax tables, and see for yourself.) It was all someone's misguided notion that, if you lower the tax rates, it will stimulate the economy, the money would be invested, and jobs would be created. (Indeed in my younger, more Libertarian and Republican days, I used to support such ideas.) But now we've seen how it works in real life. The money goes into Swiss and Cayman Island banks, trust funds, and anything else that would serve as a tax haven or shelter, or something that will generate a tax-free return. It gets hoarded, not re-invested. Even if these people would go out and buy something with it -- a 10,000 square foot mansion, a pair of his-and-her Cadillacs, anything -- the demand for goods and services, and the jobs that would be required to support that, would be worth something. But for the last ten to twenty years, our tax system has rewarded all the wrong kind of financial management and economic behavior.

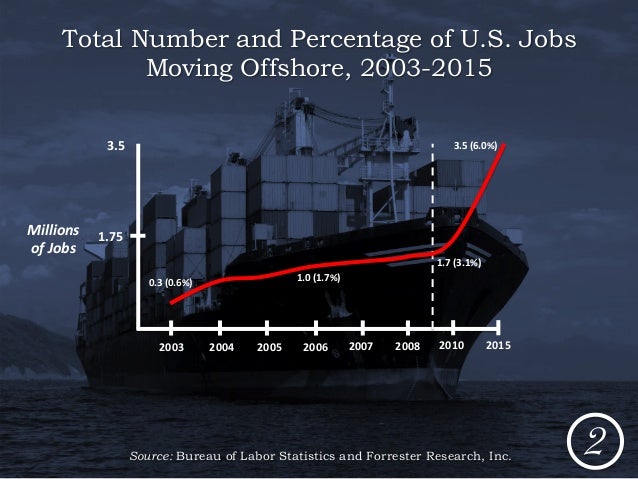

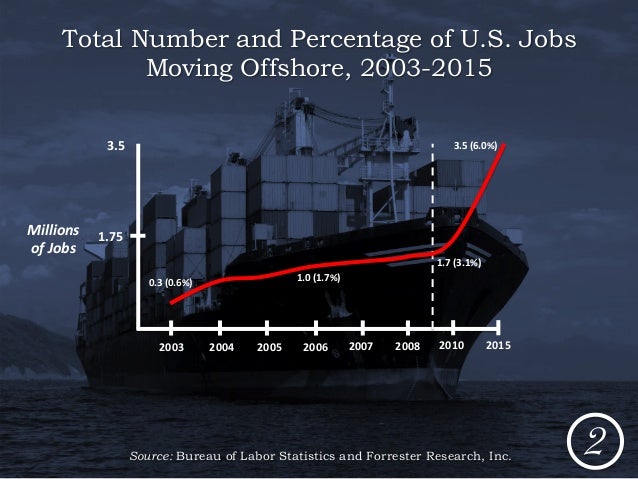

- Individuals get taxed on gross personal income, less a limited range of deductions. Corporations get taxed on income, less expenses - nearly anything a corporation spends is tax deductible. (Not that some things corporations spend money on should be - lobbying, and campaign contributions, are prime examples of things a corporation should get no deduction whatsoever for.) So, you can actually have the maximum corporate tax rate be pretty high, without hurting anything or anyone. Corporations need to be able to pay dividends to little old ladies who clip coupons, and rely upon the dividends for income (such individual income, at least the first $10,000 or so of it, shouldn't be taxable at all, since it amounts to double taxation). But having a high maximum corporate tax rate, which only taxes corporate profits (and corporate tax rates should be calculated on the basis of profits per outstanding share, not gross profits), would encourage reinvestment of those profits. Real reinvestment, not tax shelters. Not offshore investment (you shouldn't get any deduction for that at all). America is the only country in the world that gives tax credits for shipping jobs offshore, effectively subsidizing its own deindustrialization at taxpayer expense. It must stop already.

Originally appeared on Quora

No comments:

Post a Comment